The banking ecosystem in India has undergone rapid transformations in the last few years. Among all the changes, the role of API (Application Programming Interface) in converting the banking institutions and neo banks into financial powerhouses has been significant.

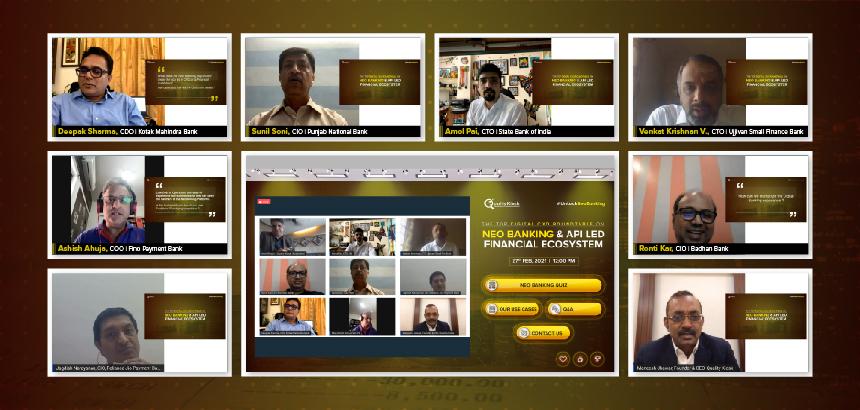

Underlining the importance of API in revolutionizing financial institutions, QualityKiosk organized a top CXO digital roundtable for BFSI domain titled-Neo Banking & API Led Financial ecosystem on 27th February 2021 with the following agenda:

• Is India ready to adopt Neo-Banking?

• Business models that banks can adopt to attain value from its evolution and increase the digital revenue

• Capitalizing Hyper personalization and monetizing end-user experience

• Ensuring profitability with a narrow range of product offerings and no physical presence

• Operational inexperience vis-vis Traditional banks-How to capitalize on the tech-savvy trend?

• Regulatory and compliance-subjected to the same requirements as for conventional banks

The roundtable was graced by the top CXOs from the Indian BFSI industry including

• Mr. Sunil Soni – CIO, Punjab National Bank

• Mr. Amol Pai – CTO, State Bank of India

• Mr. Venkat Krishnan V – CTO, Ujjivan Small Finance Bank

• Mr. Deepak Sharma – CDO, Kotak Mahindra Bank

• Mr. Jagdish Narayanan – CIO, Reliance Jio Payments Bank

• Mr. Ashish Ahuja – COO, Fino Payments Bank

• Mr. Ronti Kar – CIO, Bandhan Bank

• Mr. Maneesh Jhawar – Founder & CEO, QualityKiosk Technologies

The introductory note was given by Dr. Divya Gajria – AVP | Marketing, QualityKiosk Technologies, and the discussion was moderated by Mr. Amit Bhasin – EVP | Product Strategy and Marketing, QualityKiosk Technologies.

You may stream the live recording of the roundtable here.