Transforming Fintech CX with Agentic AI using DevRev: A Modern Approach to Quality Engineering from QK

By Abilash Narahari

The fintech industry operates in an environment where a single payment failure or security glitch can cost millions in revenue and damage customer trust. Digital payment platforms and financial services technology face unprecedented pressure to deliver flawless user experiences while maintaining the highest security standards. Yet, traditional quality engineering approaches fail to meet these demanding requirements.

Fintech leaders are discovering that reactive bug fixing and siloed testing processes are inadequate for modern customers. They expect instant and seamless financial transactions and there’s no room for the “find and fix later” mentality that characterizes conventional quality assurance.

To understand why a fundamental transformation is needed, it’s essential to examine the specific quality engineering challenges that are holding fintech companies back from achieving their full potential.

The Fintech Quality Engineering Challenge

Fintech companies face unique quality challenges that go far beyond traditional software testing. The stakes are higher, the regulatory requirements more stringent, and the customer expectations more demanding than in most other industries. Some common challenges include:

Reactive over Proactive. Fintech companies often operate in firefighting mode, uncovering critical issues only after customers disclose them or raise bugs in production. This reactive approach leads to transaction failures, compromised user trust, and potential regulatory violations.

Disconnected Data Silos. Customer transaction data, fraud detection alerts, and testing information exist in various distributed systems, making it nearly impossible to understand the complete picture of product quality and user experience.

Technical Debt Accumulation Without visibility into the impact of technical decisions, fintech companies accumulate technical debt that eventually manifests as payment processing bottlenecks, security vulnerabilities, and compliance issues.

Slow Root Cause Analysis. When payment systems fail or security incidents occur, fintech teams spend an invariable amount of time investigating the root cause across disconnected tools and datasets, leading to prolonged service disruptions and frustrated customers.

Lack of User-Centric Focus. Traditional testing approaches focus on functional requirements rather than actual user journeys and real-world financial usage patterns, missing critical experience gaps.

QualityKiosk's Approach: Agentic Quality Engineering

At QualityKiosk, we’ve developed a comprehensive methodology that transforms quality engineering from a reactive function into a proactive, intelligence-driven capability designed specifically for the unique demands of the fintech industry.

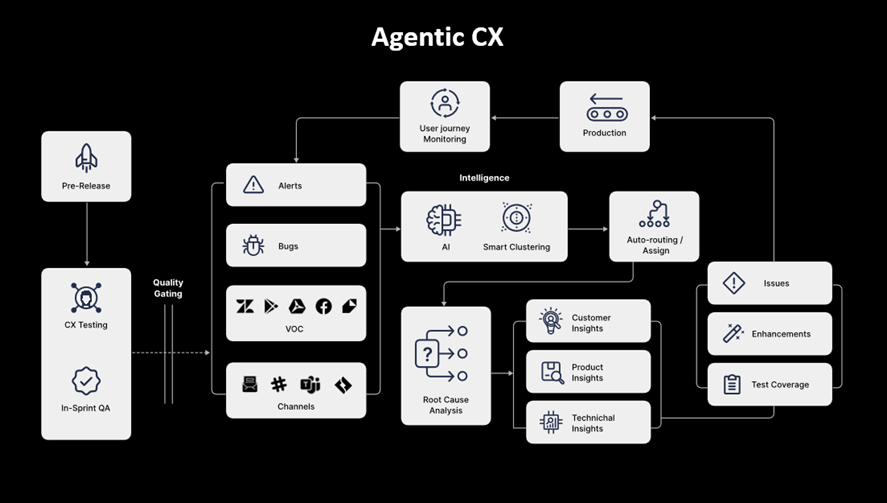

Our approach centers on “Agentic CX,” where we place customer experience at the heart of quality engineering through AI-powered insights and automation. Working in strategic partnership with DevRev, we leverage their AI-native platform to establish the foundation for our agentic quality engineering framework. DevRev’s capabilities in real-time user journey monitoring, smart clustering, and AI-powered knowledge graphs make it the ideal platform for realizing our vision of truly data-driven quality engineering throughout the DevOps process.

Our Core Philosophy

Building on our 25 years of expertise in digital quality engineering, we develop a set of guiding principles to realize our collaborative vision of Agentic CX for user-first quality engineering:

Lean Documentation: We prioritize the creation of efficient and relevant documentation to support effective problem understanding and resolution, ensuring that our reporting on testing activities is clear.

User-First Quality Engineering: Every testing and quality decision is driven by actual user behavior and feedback, not just technical specifications. This involves detailed examination of the UI/UX (user interface and user experience), helpfulness of error messages, and ease of navigation within financial applications.

Align with Business Goals: All our quality engineering activities are directly linked to improving key business outcomes such as customer satisfaction and retention in the competitive fintech landscape.

Delivering Holistic Value Across Departments: Information is synthesized from customer interactions, product telemetry, and testing outcomes to provide improvement that reflect business metrics.

Comprehensive Test Coverage: Our testing strategy encompasses all stages of fintech development and involves a diverse range of testing activities that identify and resolve defects proactively rather than reactive fixing.

The QualityKiosk Implementation Framework

Phase 1: Assessment and Foundation Building

We begin with a comprehensive assessment of existing quality processes, tools, and data sources. This phase focuses on:

- Evaluating current testing coverage and effectiveness

- Identifying data silos and integration opportunities

- Establishing the foundational platform for AI-powered quality intelligence

- Conducting initial proof-of-concept testing to validate the approach

Phase 2: Full Deployment and Optimization

Building on the established foundation, we deploy the complete quality engineering framework:

- Implementing comprehensive monitoring and analytics dashboards

- Configuring intelligent workflows for automated issue routing and prioritization

- Rolling out full-scale testing across all product areas

- Training teams on the new quality-first mindset and tools

Phase 3: Maintenance & Continuous Optimization

In the final phase, the focus shifts to maintaining product stability and enhancing performance. We achieve this through:

- Continuous monitoring, user journey analytics, and adaptive testing

- Leveraging DevRev’s AI-driven insights to proactively identify and resolve emerging issues in production

- Ensure seamless user experiences, and support rapid iteration for future releases. This phase ensures sustained quality and alignment with evolving business goals.

Key Components of Our Solution

Our agentic quality engineering framework integrates multiple AI-powered components that work together to create a comprehensive view of product quality and customer experience.

Each component is specifically designed to address the unique challenges fintech companies face, such as:

VOC (Voice of Customer) Integration. We centralize and analyze customer feedback from multiple sources, such as support tickets, app store reviews, surveys, and social media, to identify patterns and prioritize quality improvements based on real user impact.

AI-Powered Knowledge Correlation. Our intelligent systems create connections between customer complaints, product metrics, and testing results, giving teams the full context of any quality issue quickly.

Smart Issue Clustering. By automatically grouping related problems, alerts, and feedback patterns, we dramatically reduce the noise and help teams focus on the most critical issues.

Real-Time User Journey Intelligence. We monitor actual user interactions continuously in production environments, providing immediate insights into how customers experience your product in real-world conditions.

Automated Quality Gates. Data-informed checkpoints are embedded throughout the development lifecycle, automatically flagging potential issues before they reach production.

Intelligent Workflow Optimization. Issues and enhancement requests are automatically routed to the right teams with appropriate priority levels, streamlining resolution processes and improving overall efficiency.

Business Outcomes You Can Expect

Companies implementing our Agentic-AI driven and DevRev-led QE approach typically see:

Minimized Mean Time to Detect (MTTD). AI-powered monitoring and root cause analysis reduce mean time to detect critical issues to under 5 minutes. We continuously improve this timeline with the goal of reducing customer-reported incidents to zero.

Minimized Mean Time to Resolve (MTTR). Harnessing smart clustering and integrated knowledge graphs through the DevRev platform, we help fintech leaders resolve issues significantly faster, reduce ticket deflection rates, prioritize defects, and enhance mean time between failures.

Enhanced Engineering Productivity. With AI helping teams gather actionable insights, prioritize defects, and drive user-centric product development, we help fintech clients direct engineering efforts towards strategic improvements and feature development rather than constant firefighting.

Improved Customer Satisfaction. Proactive issue prevention and user-centric development approaches lead to measurable improvements in customer satisfaction scores and retention rates.

Industry-wide Applications

This approach has proven effective across various sectors:

Financial Services: Payment platforms and banking applications can benefit from the enhanced reliability and user experience focus, critical for maintaining customer trust in financial transactions.

E-commerce: Online retailers can use the framework to ensure smooth customer journeys during peak shopping periods and identify experience gaps that impact conversion rates.

Healthcare Technology: Medical software companies can leverage the approach to maintain compliance while ensuring user-friendly interfaces for healthcare professionals.

Enterprise Software: B2B SaaS platforms can implement the methodology to reduce customer churn and improve user adoption of complex software solutions.

Getting Started with Modern Quality Engineering

Transforming quality engineering requires both technological capability and cultural change.

We recommend starting with:

- Assessment: Understanding your current quality landscape and identifying the biggest pain points

- Pilot Implementation: Beginning with a focused area to demonstrate value and build organizational confidence

- Gradual Expansion: Scaling the approach across additional products and teams based on lessons learned

- Continuous Evolution: Regularly refining the approach based on new data and changing business needs

The Future of Fintech Quality Engineering is here.

The future is for organizations that view quality engineering not as a cost center, but as a strategic differentiator. By harnessing AI to create proactive, user-centric quality processes, companies can deliver exceptional experiences while reducing costs and accelerating innovation.

The shift from reactive to proactive quality engineering is a fundamental reimagining of how companies should approach product quality and customer experience. Those who make this transformation now will have a significant competitive advantage in an increasingly experience-driven marketplace.

Abilash Narahari

Vice President, Head of Technology & Digital Natives

Recent Post

Get insights that matter. Deliver experiences that

are simply better.

We can scale Elastic to you. Let us show you. Schedule a complimentary consultation with our experts or request a demo of Elastic today

© By Qualitykiosk. All rights reserved.

Terms / Privacy / Cookies