A Business Leader’s Guide to Modernizing UAT in Wholesale Banking for 2025

Consider a business user carrying out User Acceptance Testing (UAT) of a new trade finance application. He flags an issue—”when uploading documents, there is no confirmation message or feedback on the UI”.

This simple case highlights how business users understand usage of applications, critical workflows and outputs in ways IT testers might overlook. UAT is important in ensuring that applications meet real-world user expectations.

Experts in wholesale banking recognize UAT’s importance, but time constraints often lead to shortcuts, risking unforeseen issues in real-world scenarios. A balanced approach ensures thorough coverage without compromising timelines.

While UAT is crucial, most of the time this process is run manually with busy business users carrying out time-consuming tests, one at a time. By automating repetitive testing tasks, business users can focus their efforts and expertise on core business roles while augmenting critical workflows.

Let’s explore how you can tackle UAT challenges by leveraging automation, AI, and modern testing approaches to stay ahead in 2025.

Key Takeaways:

- Automating UAT accelerates testing cycles, ensures accuracy, and simplifies workflows, enabling faster software deployments.

- AI-driven tools enhance UAT by detecting issues, adapting to compliance changes, and reducing risks for smoother operations.

- Partnering with third-party providers brings expertise, custom tools, and efficient frameworks to optimize UAT for banking.

Manual UAT is Detailed. But It Has Its Challenges

Manual Testing is Slow

Limited Availability of Business Users

Business users, who bring critical domain expertise, are often stretched thin with their day-to-day responsibilities. Allocating time for exhaustive testing can be difficult, leading to gaps in UAT coverage.

Consider testing a credit limit approval workflow in a wholesale banking system. A relationship manager will be pressed on bandwidth to thoroughly validate scenarios like dynamic limit calculations or approval escalations, risking oversight of key anomalies.

Difficulty in Testing Edge Cases

Challenges of Manual Testing

- Time-Consuming: Requires more time to execute compared to automated testing.

- Human Error: Susceptible to mistakes, especially in repetitive tasks.

- Not Ideal for Large Scale Testing: Less efficient for large projects with extensive testing needs.

Manual UAT often struggles to address the complexities of business applications and workflows.

Sarah, the UAT lead at a prominent treasury management firm, faced a challenge with manual testing of their payment workflows. The whole process was eating up a lot of the business users’ time. Every release required her team to manually validate repetitive scenarios, such as domestic and international wire transfers, payment rejections, and confirmations.

That’s when Sarah started evaluating the possibility of bringing automation in UAT with the goal of freeing up time for her team, and to speed up the releases.

To understand it better, let’s see how automation and AI can help overcome the challenges of manual UAT.

Moving from Manual Testing to Automated UAT

Increased Speed and Efficiency

Automated UAT tools can execute hundreds of test cases simultaneously, drastically reducing the time required for comprehensive testing. This improves testing cycles, enabling you to deploy software updates faster.

Imagine an internet banking team that needs to release a new mobile banking app with transaction security features. By automating the user tests for functionalities such as secure logins, fund transfers, and bill payments, the bank can significantly reduce the time required to validate the app’s functionality, performance and security.

Error Reduction

Automated testing eliminates repetitive human tasks, reducing error rates. In a survey conducted by Harvard Business Review, nearly 90% of workers said they trusted automation solutions to get more done without errors, and help them make decisions faster.

Manual testing often falls short when precision and scalability are critical.

Priya, the Head of IT at a busy wholesale bank, faced a significant challenge when a high-value international transaction bypassed necessary approvals due to a missed defect during manual UAT. The incident caused delayed settlements and dented the bank’s reputation.

To prevent such incidents, Priya automated repetitive testing tasks in UAT. The system of automated tests validated functionalities like fees calculation, currency conversion, and multi-level authorization across wire transfers, SWIFT payments, and ACH transactions.

With automated UAT you can test different functionalities, driving accuracy and compliance. However, the right tools are key to successful automated UAT.

Let’s explore tools that simplify UAT for digital applications in wholesale banking.

How Are Automation Tools Used in UAT?

The automation testing market has exploded to $25 billion, highlighting the growing reliance on advanced testing tools across industries.

Below, we explore how some of the popular automation tools can be used in UAT of banking applications:

| Tool | Main Use | UAT Example |

| Selenium | Open-source tool for automating web applications across browsers | Automate repetitive tasks like checking the accuracy of fee calculations in loan applications and verifying currency conversions & document uploads across multiple browsers. |

| Appium | Automates UAT for mobile apps | Validate workflows like two-factor authentication, multi-level payment approvals, and transaction reports in mobile banking apps. |

| Katalon Studio | Versatile test automation tool for web, API, and mobile testing | Automate end-to-end testing of loan origination systems or transaction approval workflows to ensure functional accuracy. |

| Cucumber | Behavior-driven development (BDD) tool | Test trade finance platforms using plain language scenarios, e.g., validating credit limits and issuing a Letter of Credit. |

| BrowserStack | Cloud-based tool for cross-browser testing | Test online banking portals and mobile applications across various browsers and devices to ensure a smooth user experience. |

| Postman | Primarily used for API testing | Validate APIs for payment processing, fraud detection, and fund transfers to ensure correct responses. |

| RPA Tools | Automates repetitive test tasks | Streamline data entry in trade finance systems, automate invoice processing, or perform credit checks. |

To effectively manage and execute these test cases, organizations also rely on robust test case management tools that simplify the entire testing process. Tools like JIRA, Zephyr, TestRail, and qTest are essential for managing and tracking UAT test cases. JIRA, a popular project management tool, can be used to create, prioritize, and track test cases, while Zephyr, TestRail, and qTest offer specialized features including test case execution and reporting.

When doing UAT of a trade finance or loan application, you can use JIRA to track the overall UAT project, while leveraging Zephyr to manage specific test cases. This integrated approach ensures effective test planning, execution, and analysis, leading to higher-quality software releases.

While these tools are powerful, integrating AI can further enhance UAT’s outcomes.

AI-Powered UAT: Beyond Traditional Automation

Integrating AI with UAT can improve testing outcomes. It helps automate complex test cases, analyze large data sets, and spot patterns in test results, making UAT more accurate and efficient.

Some of the real-world scenarios of using AI in UAT for banking are:

- AI can automatically generate complex data sets for testing transaction workflows, ensuring tests cover a range of possible real-world scenarios.

- AI-powered automation tools can create and execute test scripts, reducing manual effort and accelerating the testing process.

- AI algorithms can prioritize test cases based on risk factors, ensuring that critical functionalities are thoroughly tested.

- AI can automatically repair broken test scripts (called self-healing tests), reducing maintenance efforts and improving test stability.

- AI-driven analytics can provide valuable insights into test results, identifying trends, and highlighting areas for improvement.

- AI can analyze user behavior and identify potential usability issues, ensuring a seamless user experience across different devices and browsers.

While AI simplifies testing efficiency, new approaches in UAT can add more depth and structure to the UAT process.

Also Read: AI in Quality Engineering

New Approaches for Faster and Better UAT

Shift-Left Testing

Behavior-Driven Development (BDD)

BDD frameworks use simple language to define test scenarios, bridging gaps between technical and non-technical teams. Raj’s team uses BDD tools like Cucumber to create clear test cases for cross-border payments, ensuring all stakeholders understand the requirements and no functionality is missed.

Parallel Testing

Real-time Monitoring

Benefits of UAT Automation

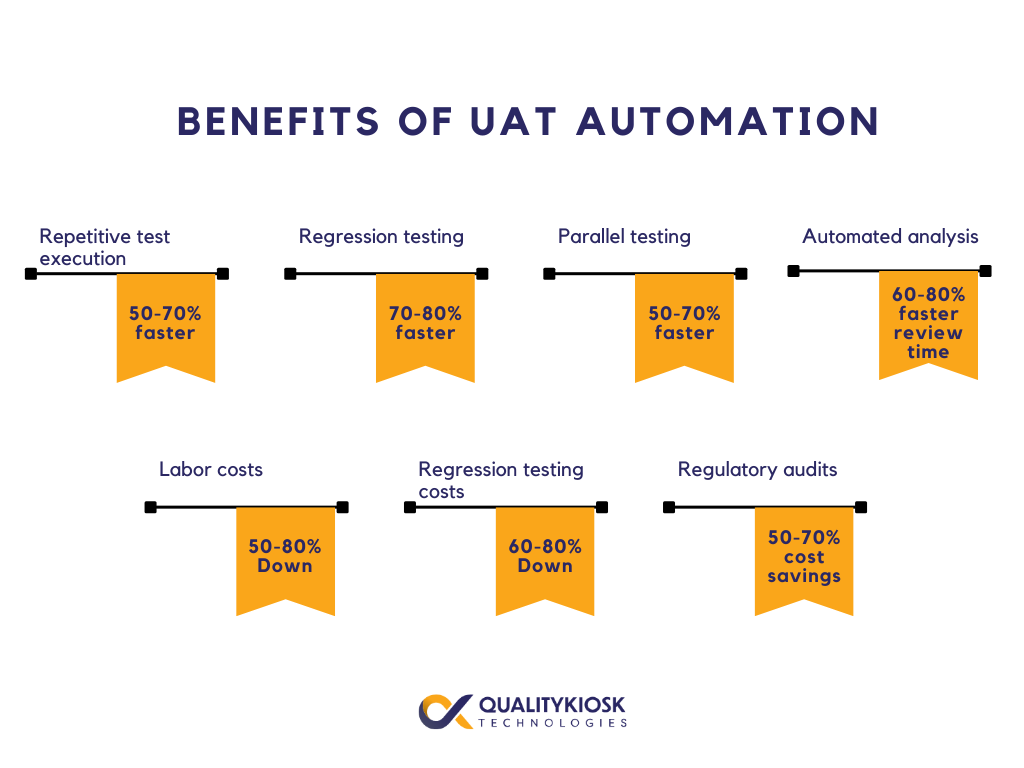

- Efficiency: Automation can slash repetitive test execution time by 50-70%, while regression testing sees 70-80% faster completion.

- Coverage: Parallel and data-driven testing can ensure broader coverage in 50-70% less time, identifying defects early and reducing post-release fixes.

- Optimization: Automated test result analysis can cut time spent by 60-80%, freeing up resources for more strategic tasks.

- Cost-Savings: With 50-80% savings in labor costs and 60-80% savings in regression testing costs, automation can optimize testing budgets.

- Compliance: Automated compliance tests and audit trails can save 50-70% of regulatory costs, ensuring seamless adherence to industry standards.

Imagine tests for standard processes like transaction validation and account setup getting executed in seconds. Additionally, if your functionality and UI changes often, AI-driven self healing can adapt test scripts to UI and functionality changes.

However, implementing such advanced automation in-house can be daunting, requiring simultaneous skills in project management, domain expertise, testing knowledge, automation and AI.

This is where partnering with a third-party provider becomes invaluable.

The Role of a Third-Party Provider

Key Factors to Consider When Selecting a Third-Party Provider:

- Look for providers with a deep understanding of the banking industry and specific domain knowledge.

- Consider their experience in delivering successful UAT projects and their ability to adapt to evolving industry trends.

- Choose providers that offer cutting-edge tools and technologies to drive innovation and efficiency.

- The provider should be able to build a UAT framework to provide a structure for improvements in UAT.

- They should be able to provide reliable and responsive customer support. This is crucial for timely issue resolution and a seamless partnership.

- Evaluate the provider’s pricing model and the overall value they bring to the table.

- Look for providers with the ability to handhold business users and train them on automated processes.

Conclusion: Automating UAT with QualityKiosk

AI, automation, and advanced UAT frameworks have the potential to transform testing in wholesale banking, enabling the delivery of high-quality solutions and exceptional customer experiences while reducing costs and accelerating time-to-market.

QualityKiosk stands out as a trusted UAT automation partner that offers tailored solutions for wholesale banking. With expertise in AI, machine learning, and robust UAT frameworks, QualityKiosk addresses complex challenges and ensures compliance with rigorous standards.

For instance, we successfully implemented a Shift-Left approach for a leading bank, accelerating application launches by 58% and significantly reducing critical issues.

Partner with QualityKiosk to simplify UAT and confidently drive your digital transformation journey into 2025. Contact us to learn more.