The result? Observability is shifting from reactive monitoring to proactive, AI-driven insights that predict and prevent disruptions. With AI-powered observability platforms like Dynatrace, banking systems can seamlessly anticipate issues before they escalate. As banking infrastructure becomes more intricate with hybrid environments combining legacy systems and modern microservices, observability is no longer a tool—it’s a strategic necessity.

Key Takeaways:

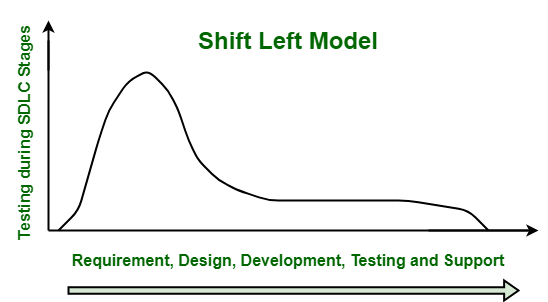

- Trends like shift-left observability and AI monitoring can reduce downtime, accelerate development, and ensure system stability.

- Integrating observability with cybersecurity can protect against sophisticated fraud threats and improve compliance.

- Partner with QualityKiosk to leverage AI-powered observability platforms like Dynatrace, which helps banks deliver smooth customer experiences and reliable systems with advanced observability solutions.

Top 5 Observability Trends for Banking

Trend 1: Emergence of AI Observability

For example, a sudden spike in transaction volumes during peak hours could trigger cascading failures. At QualityKiosk, we leverage a combination of proprietary, open-source, and licensed tools—like Dynatrace—to quickly identify the root cause (say, an overloaded API or misconfigured service) and trigger automated remediation.

Beyond infrastructure, the rise of Generative AI (GenAI) has introduced a critical dimension to observability: understanding and monitoring the performance and behavior of AI models themselves.

Trend 2: Automation in Observability Pipelines

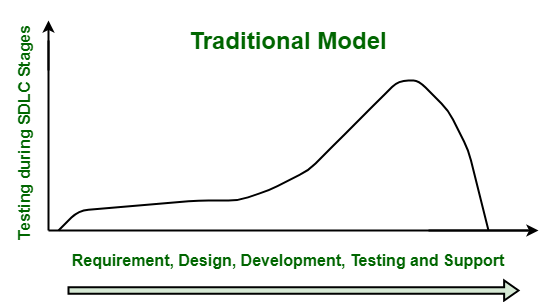

Trend 3: Shift-Left Observability

Trend 4: Observability Integrated with Cybersecurity

Trend 5: Enhanced Customer Experience Monitoring

- Track the full customer journey, from login to transaction completion.

- Visualize customer interactions to pinpoint frustrations, like failed transactions using its session replay feature.

- Resolve issues, such as slowdowns or error spikes, before they affect users using AI.

Partner with QualityKiosk for Observability Excellence

As the banking sector continues to evolve, observability is a strategic advantage, ensuring that banks remain agile, resilient, and customer-focused. Notably, 47% of IT decision-makers highlight its role in achieving business KPIs, underscoring its critical impact on business success.

QualityKiosk is your trusted partner for achieving observability excellence in banking using Dynatrace. We offer end-to-end Dynatrace implementation, ensuring seamless integration across your infrastructure. Our services include real-time monitoring and 24/7 support to proactively identify and resolve issues, ensuring peak performance and uninterrupted service. With QualityKiosk, you can enhance system reliability and deliver a seamless customer experience.

To transform your own observability strategy, schedule a consultation with QualityKiosk today.

About the Author

Vivek Porwal, EVP, Consulting and Banking Practice Head at QualityKiosk Technologies, is a seasoned BFSI and digital transformation veteran with over two decades of experience in Consulting, QA, and Auditing. At QualityKiosk, he leads multiple digital quality assurance projects for major BFSI players worldwide. With a focus on areas like Digital Lending, Open Banking, and Omni-channel, Vivek’s domain expertise has enabled global financial organizations to achieve digital transformation and meet business objectives.

A frequent speaker at international forums, he covers topics like Digital Transformation, Digital Payments, Open Banking, RPA, and DevOps. Vivek is a CISA and holds an Executive Management Program from Harvard Business School, along with certification as a Master Agile Testing Professional (CP-MAT).