Digital

modernization

projects delivered

Reduction in

regression testing

times

Reduction in

Quality Engineering

costs

Zero

A leading global financial institution, majoring in banking and insurance services, undertook a strategic initiative to migrate its newly acquired life insurance division from a legacy mainframe to eBaoTech, a modern, cloud-based core insurance platform. This digital transformation aimed to enhance scalability, operational efficiency, and compliance with evolving regulatory standards. The success story highlights how the client overcame several key challenges during this complex migration by partnering with QualityKiosk Technologies.

Implementing an eBaoTech or other cloud migration project for an insurance company presents a complex array of challenges, including technical data issues, ensuring compliance with regulatory standards and maintaining business continuity.

These included:

Legacy System Integration

Integrating data from the existing mainframe with the new cloud platform required meticulous planning and validation.

Data Integrity and Consistency

Ensuring the accurate migration of policy data, financial records, and transactional details across systems was crucial

Data Migration Defects

Mitigating the risk of data loss or corruption during the transfer process

Regulatory Compliance

Adhering to stringent financial regulations (likeIFRS 17 and MAS regulations) in Singapore and the broader APAC region demanded rigorous testing.

Business Continuity

Maintaining seamless service during the transition to avoid disruption and negative customer impact

UAT Confidence Gap

The client lacked clarity on how UAT signoff would ensure financial accuracy and business continuity for migrated policies

Accelerate

time to market

Improve cost

efficiencies

Improve ROI for

investments made

in innovation

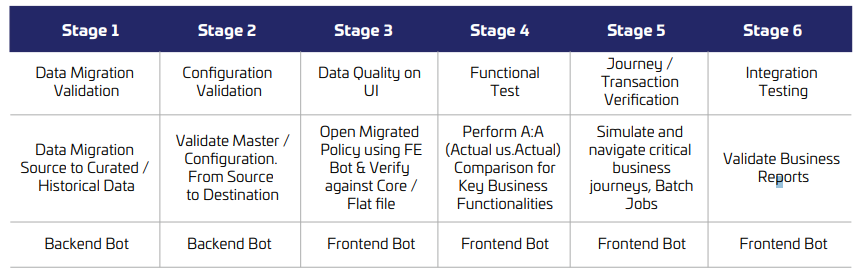

QualityKiosk implemented a robust, multi-stage data validation strategy, integrating advanced automation tools and processes to ensure a seamless platform transformation. This strategy was engineered to the unique challenges of migrating from a legacy system to eBaotech, a cloud-based insurance platform.

AI-Powered Validation

Used a Python-based comparator to ensure data integrity and accuracy.

Automated backend and frontend bots

Deployed 20+ specialized bots to streamline data migration validation, configuration validation, data quality assurance, business process validation, and BI/reporting validation.

Reusable solution accelerators

Leveraged accelerators from similar transformation projects, accelerating implementation.

Data restoration planning

Implemented a comprehensive data restoration plan to address potential data loss scenarios.

Strategic batch run planning

Meticulously planned batch runs on the legacy system to ensure data availability and minimize risks.

Streamlined UAT approval process involving business users

Empowered business users and improved collaboration across teams.

Data Migration Validation

Backend-Bot compared source (legacy) and target (cloud) data to ensure accurate migration. QualityKiosk uncovered 40–50% data migration defects missed by the client’s team during front-end validation

Configuration Validation

Backend Bot validated system configurations, including product and process rules.

Data Quality Assurance

Frontend-Bot validated a migrated policy on the new system’s UI to ensure accurate attribute mapping.

Business Process Validation

Frontend-Bot tested real-world scenarios to verify workflows and processing logic.

BI and Reporting Validation

Frontend-Bot confirmed accurate generation of BI reports, letters, and collection files.

Transactional Data Verification

Frontend-Bot verified 10M+ transaction-level data across different modules for end-to-end transaction flow.

To address the challenges, QK designed a structured, multi-stage validation strategy, integrating aduanced automation tools and processes to ensure a seamless platform transformation

To address the challenges, QK designed a structured, multi-stage validation strategy, integrating aduanced automation tools and processes to ensure a seamless platform transformation

Our solution leveraged an intelligent test data strategy to prevent duplication and optimize execution time, ensuring a seamless transformation with minimal risk. We achieved the following technical and business results:

Our deep experience in life insurance, experience in similar transformation projects, and our commitment to data accuracy and comprehensive validation made us the ideal partner for this insurance provider.

Ready to achieve 100% data accuracy in your migration to eBaotech or other cloud platforms? Speak to our experts to replicate this success.

With digital penetration skyrocketing in the Middle East, the BFSI industry continues to evolve to meet the changing demands of the digital-first customers in the region. The trend has resulted in exponential growth in digital banking services in the region, with a recent report estimating the sector to have grown at 52% between 2021 and 2023.

Our client, one of the top 10 largest banks in the UAE offering a full range of innovative retail and commercial banking services, wanted to capitalize on the exponentially growing sector in the region and proactively stay ahead of the fast-changing banking landscape. To accomplish its goal, the UAE banking giant was undertaking an IT modernization journey to futureproof its digital ecosystem for high-velocity innovation, enhanced reliability, and user-centric experiences.

Combining the trifecta of proprietary processes, expertise, and technology, QualityKiosk analyzed the bank’s requirements and established a Testing Center of Excellence (TCoE) to enable accelerated quality engineering at scale.

Leveraging an AI-first approach, the TCoE helped the banking giant:

Download the complete case study today and access the roadmap to enable AI-powered enterprise-wide testing.

With digital penetration skyrocketing in the Middle East, the BFSI industry continues to evolve to meet the changing demands of the digital-first customers in the region. The trend has resulted in exponential growth in digital banking services in the region, with a recent report estimating the sector to have grown at 52% between 2021 and 2023.

Our client, one of the top 10 largest banks in the UAE offering a full range of innovative retail and commercial banking services, wanted to capitalize on the exponentially growing sector in the region and proactively stay ahead of the fast-changing banking landscape. To accomplish its goal, the UAE banking giant was undertaking an IT modernization journey to futureproof its digital ecosystem for high-velocity innovation, enhanced reliability, and user-centric experiences.

Combining the trifecta of proprietary processes, expertise, and technology, QualityKiosk analyzed the bank’s requirements and established a Testing Center of Excellence (TCoE) to enable accelerated quality engineering at scale.

Leveraging an AI-first approach, the TCoE helped the banking giant:

Download the complete case study today and access the roadmap to enable AI-powered enterprise-wide testing.